Getting rewarded shouldn't be overwhelming.

RivenFi connects all your loyalty programs to your credit or debit card — no logins, no scans, no stress.

For merchants → Become a partner

How it works

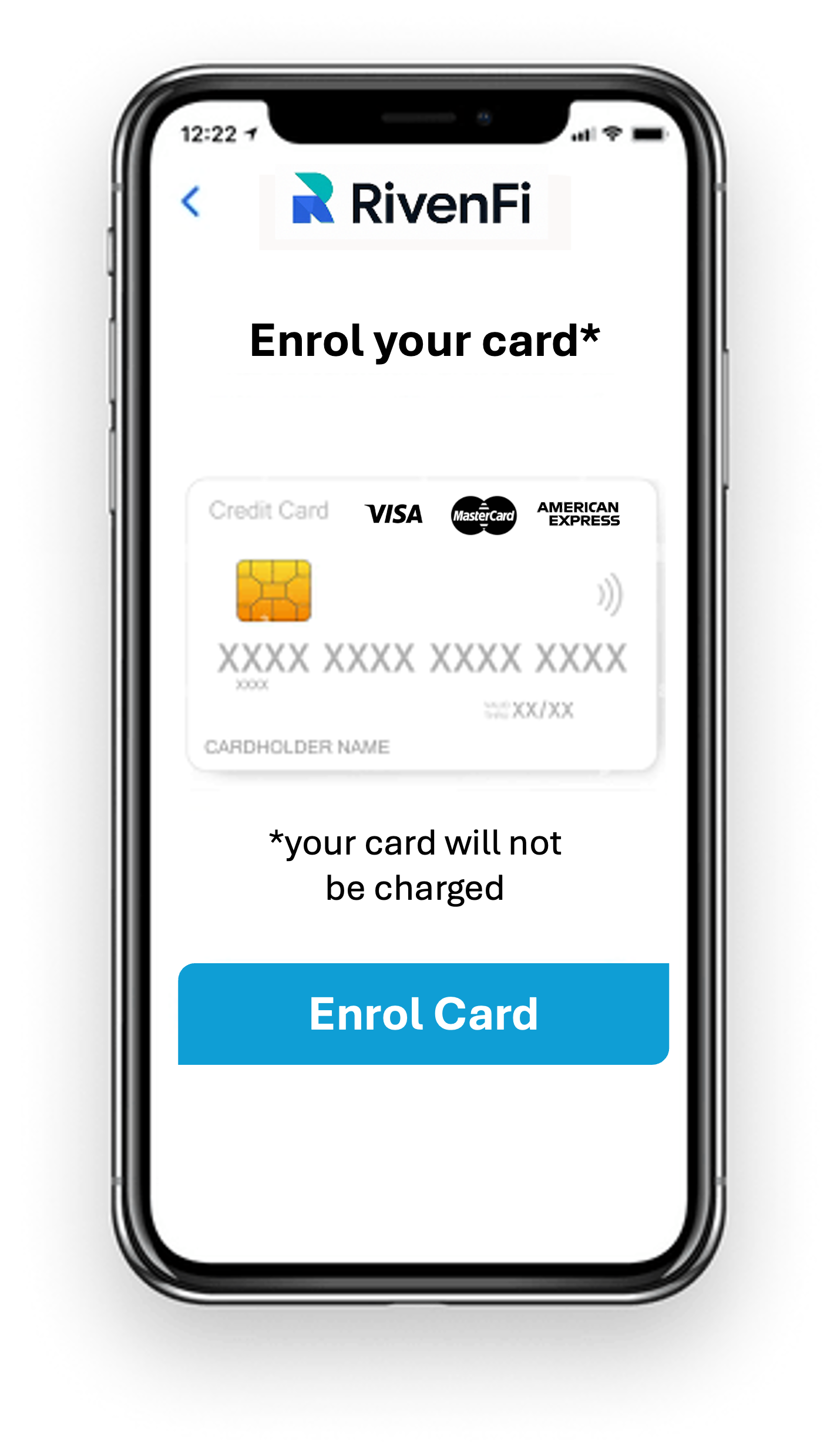

Enrol your card

Link your Credit or Debit card— your card will never be charged.

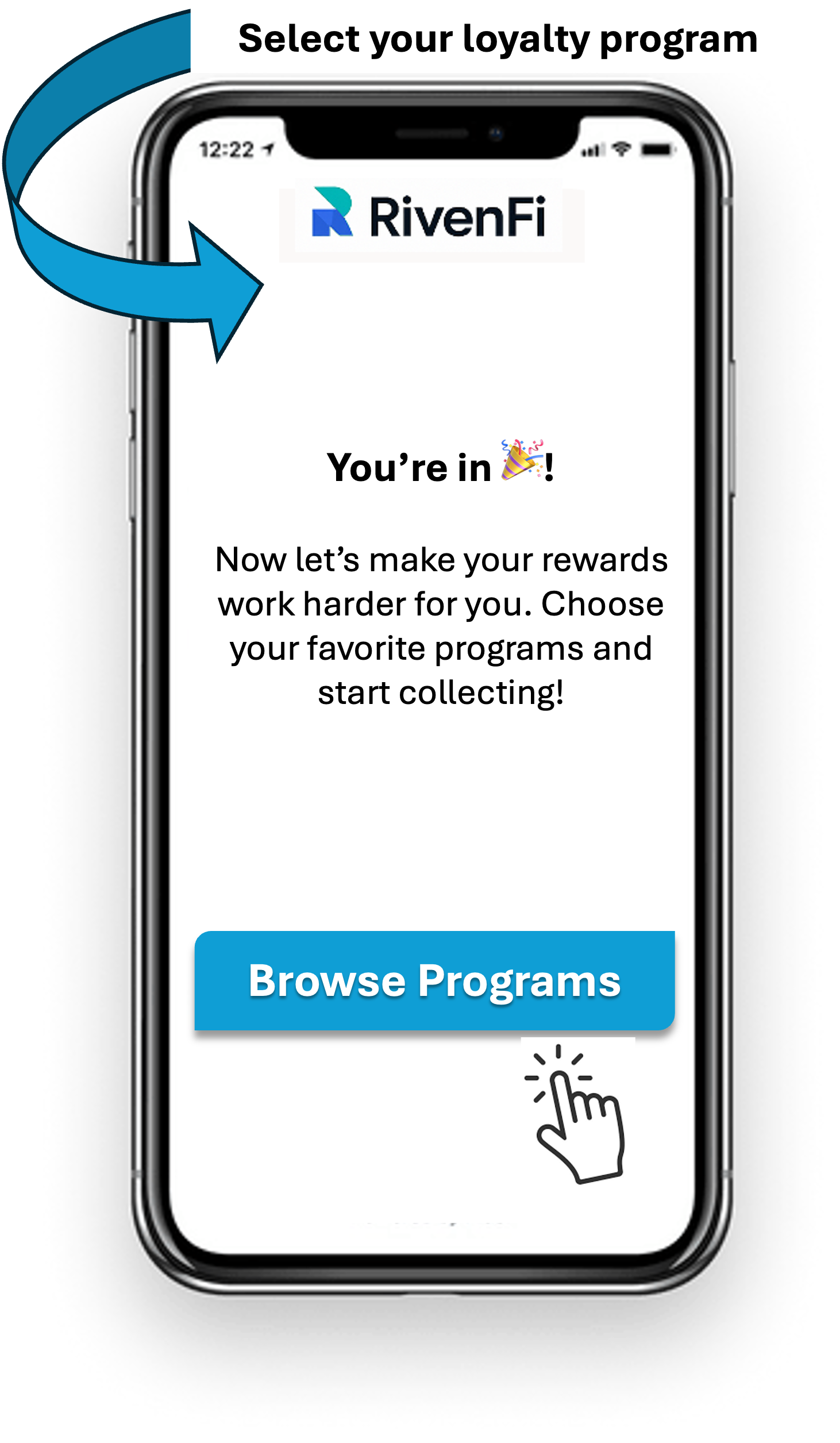

Select your loyalty programs

Select your the loyalty program you belong, or want to belong to.

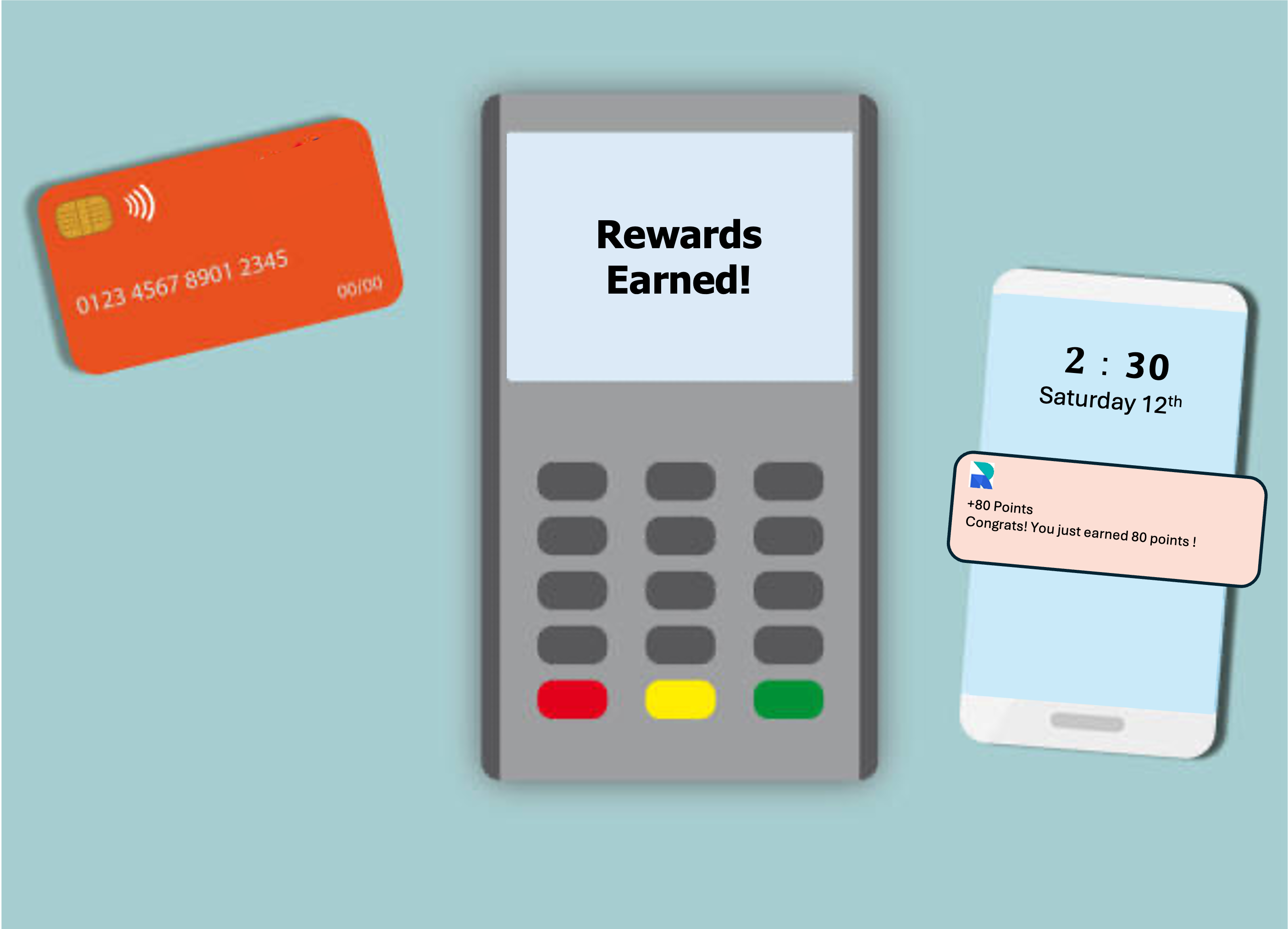

Pay and automatically collect

Tap your card as usual. We track and credit points automatically.

Track your points in one place.

Consumers

All your rewards. One simple app.

Earn automatically, no apps to open, no cards to scan. RivenFi works with the loyalty programs you already love.

Merchants

Turn your loyalty program into a growth engine.

Increase adoption, reduce churn, and keep full ownership of your customer data — without changing your systems.

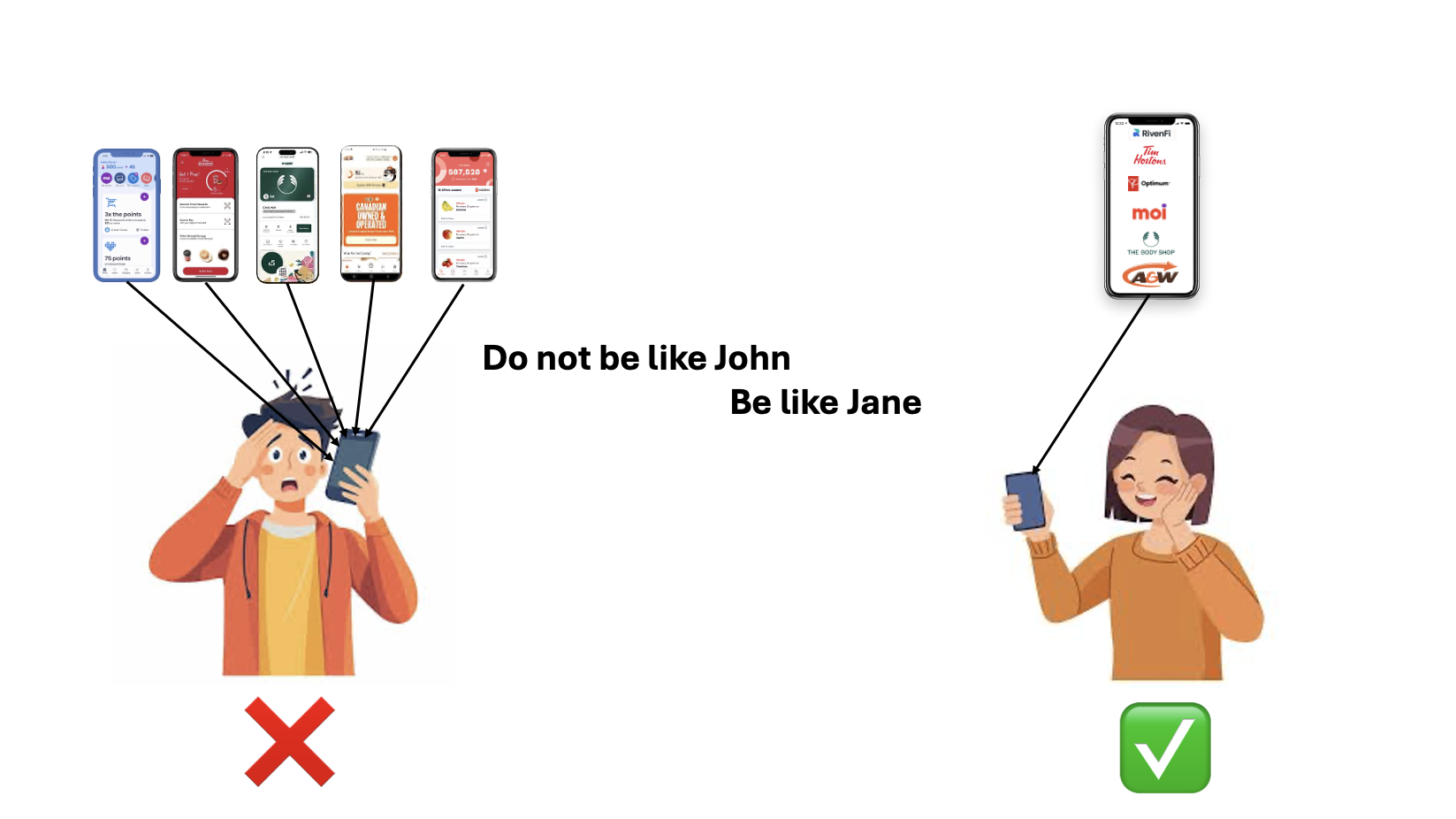

Canadians belong to 14 loyalty programs on average but only use half. Don't be the forgotten one.

Source: R3 Marketing - Statistiques clés de la fidélisation au Canada

Impact leaders care about:

- CEO — loyalty translates into more predictable growth and reduced margin pressure

- CIO — reduces infrastructure bloat from constantly onboarding new customers

- CMO — higher retention improves campaign efficiency and ROMI

Increase retention

Frictionless earning drives repeat visits and higher LTV.

Own your data

Privacy-first architecture; you keep control and governance.

Better insights

Real transaction data tied to loyalty outcomes.

Seamless integration

Works with existing systems and payment flows.